Get the Loan Facts — SBA Financing Solutions Nationwide

44 Business Capital, a division of Beacon Bank & Trust is a direct SBA lender providing SBA loans to small businesses nationwide. Small businesses are defined as companies with less than $5MM in net profit and less than $15MM in net worth. 44 Business Capital's market area is nationwide with offices in Philadelphia, Pennsylvania, New Jersey, New York, Maryland, Washington DC, Virginia, Connecticut, Massachusetts, Vermont, Colorado, Texas, Alabama, Georgia and Florida. Clients are manufacturers, restaurants, professional services, retailers, wholesalers/distributors, healthcare professionals. With terms up to 25 years and fully amortizing, these SBA loans provide long-term certainty in an uncertain economic environment.

44 Business Capital Loan Services

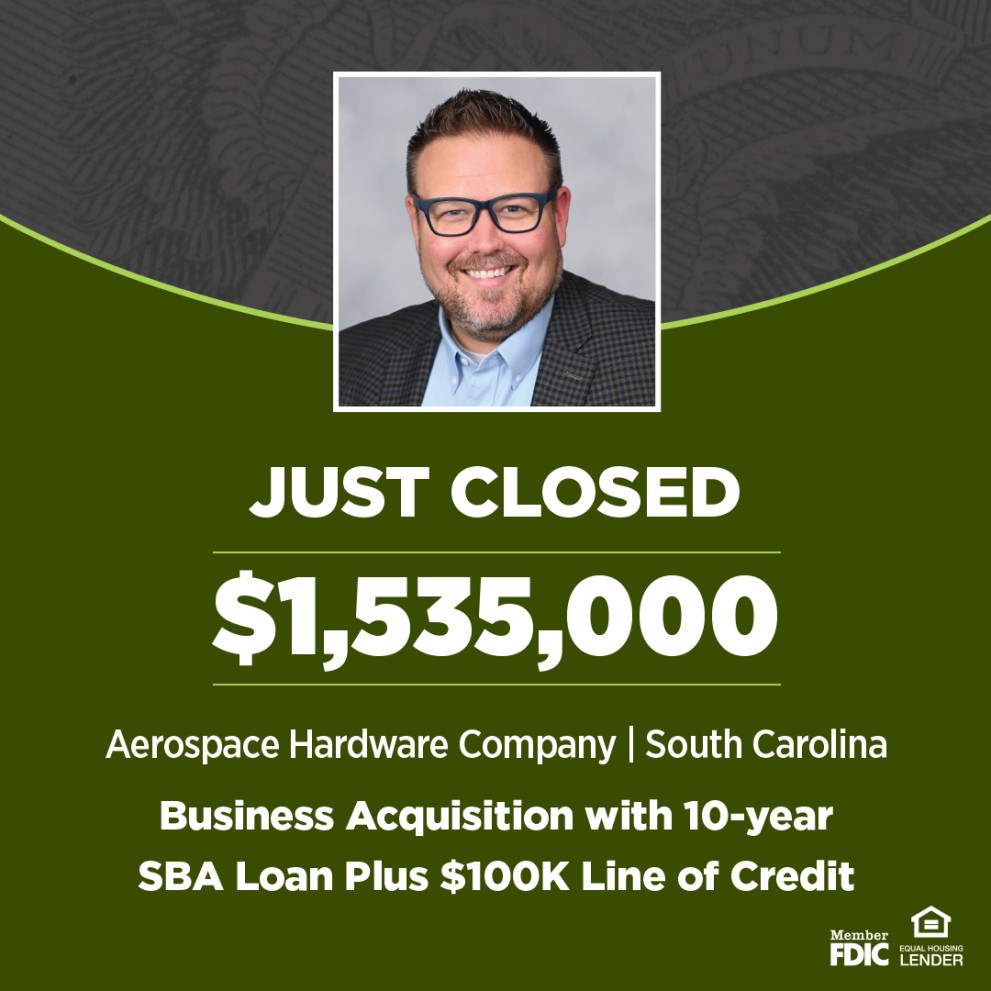

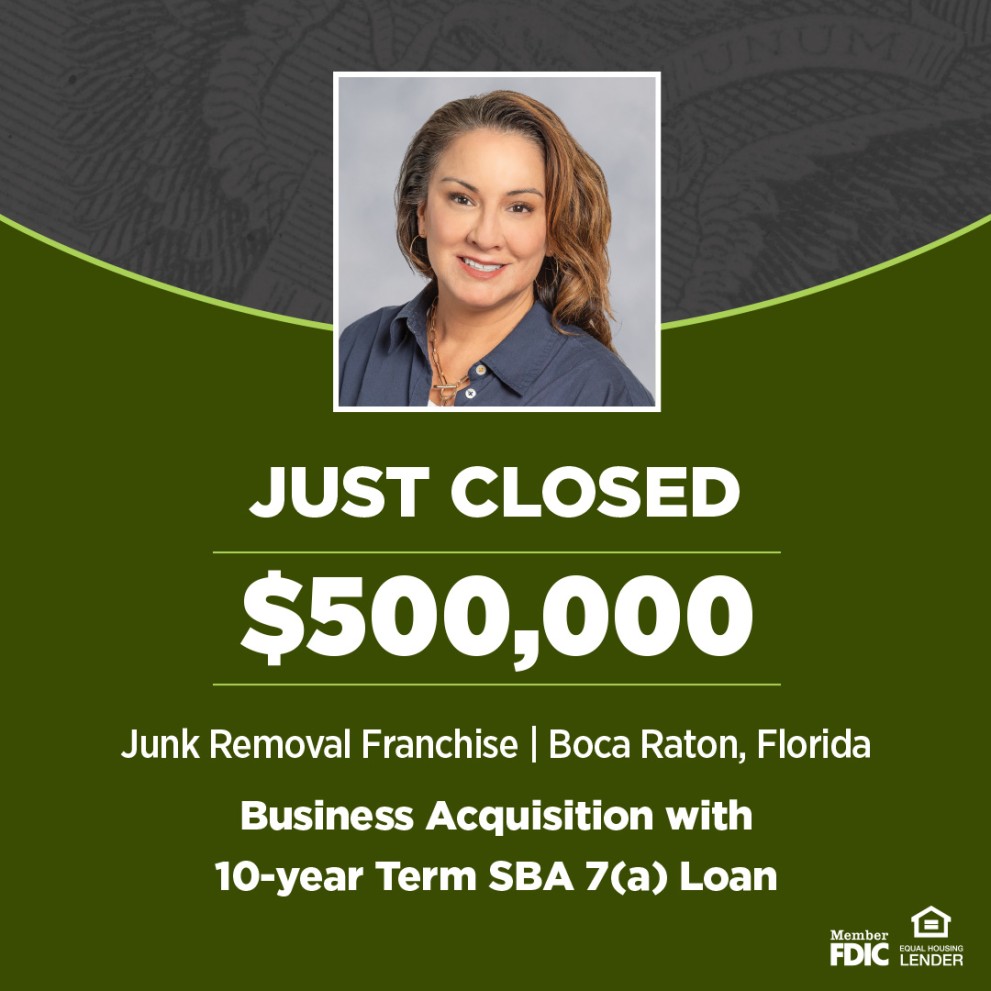

Small/Middle Market Business Loans

Loan Amount

$500,000 to $5MM

Rate

Based on Credit Quality

Terms

Up to 25 years on real estate Up to 10 years on business acquisitions, equipment and permanent working capital

LTV

Flexible; Evaluated on a deal by deal basis

Origination Fees

None

To purchase owner occupied real estate (must occupy 51% of the building) business acquisitions, equipment purchases, partner buyouts, renovation/construction or refinance existing debt.

Business Types

Manufacturing, distribution, retail, medical and other professionals, automotive and auto body repair, motels, marinas, day care centers, car washes, restaurants or any worthwhile business.

Benefit

Access to decision makers

No loan covenants

Quick response

Underwriting

We assist with loans a typical bank will not due to non-monetary defaults or covenant violations. If the business model is sound and the company is trending positively, the loan will be considered.

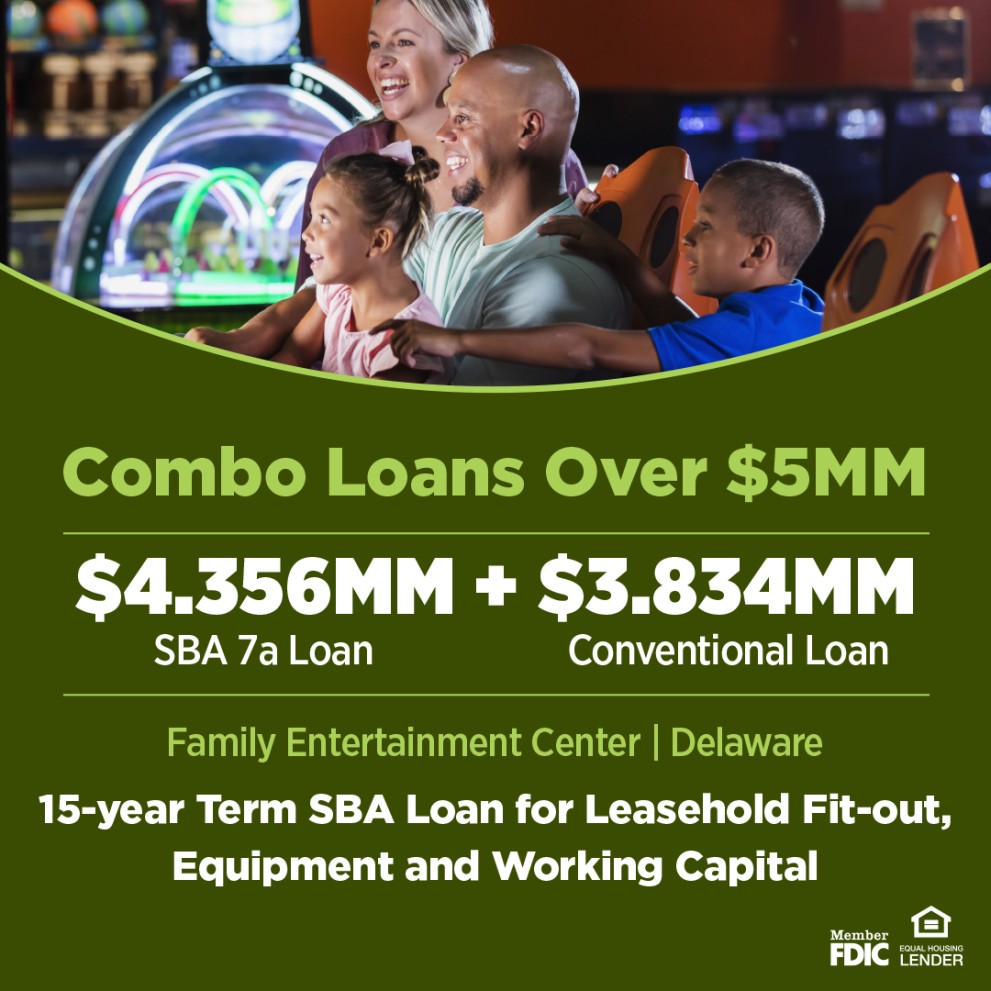

SBA + Conventional Loans

Loan Amounts

$5MM SBA 7a paired with a Conventional loan of

up to $5MM (up to $10MM total)

Rate

Based on Credit Quality

Terms

Up to 25 years on real estate

Up to 10 years on business acquisitions,

equipment and permanent working capital

LTV

Flexible; Evaluated on a deal by deal basis

Origination Fees

SBA Loan — SBA Guaranty Fee

Conventional — TBD

Prepayment Penalty

If SBA loan > 15 years - 5,3,1

Conventional — TBD

Use of Funds

To purchase owner occupied real estate (must occupy 51% of the building) business acquisitions, equipment purchases, partner buyouts or refinance existing debt.

Business Types

Manufacturing, distribution, retail, medical and other professionals, automotive and auto body repair, day care centers, restaurants or any worthwhile business.

Benefit

Deal directly with decision makers

Quick response

Flexible and sensible underwriting

Underwriting

We assist with loans typical banks avoid due to non-monetary defaults or covenant violations. If the business model is sound and the company is trending positively, the loan will be considered.

USDA B&I Lending Product

Loan Amount

$1MM to $10MM

Rate

Based on Credit Quality

Terms

Up to 30 years depending on collateral

LTV

Flexible; Evaluated on a deal by deal basis

Real Estate - 80%

Machinery & Equipment - 70%

Inventory - 60%

A/R - 60%

Conditions

Balance Sheet Equity must be at least:

10% for existing businesses

20% for new businesses

Origination Fees

One time guarantee fee of 3% of the guaranteed amount

(Loans up to $5MM are guaranteed 80%)

(Loans up to $10MM are guaranteed 70%)

Purpose

Real Estate Purchase

Machinery and Equipment Acquisition

Working Capital

Debt Restructuring/Refinance

Business Acquisition

Visit the following website:

https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

- Click on Rural Business

- Click on link for Business & Industry Program

- Input full address of project location

Frequently Asked Questions

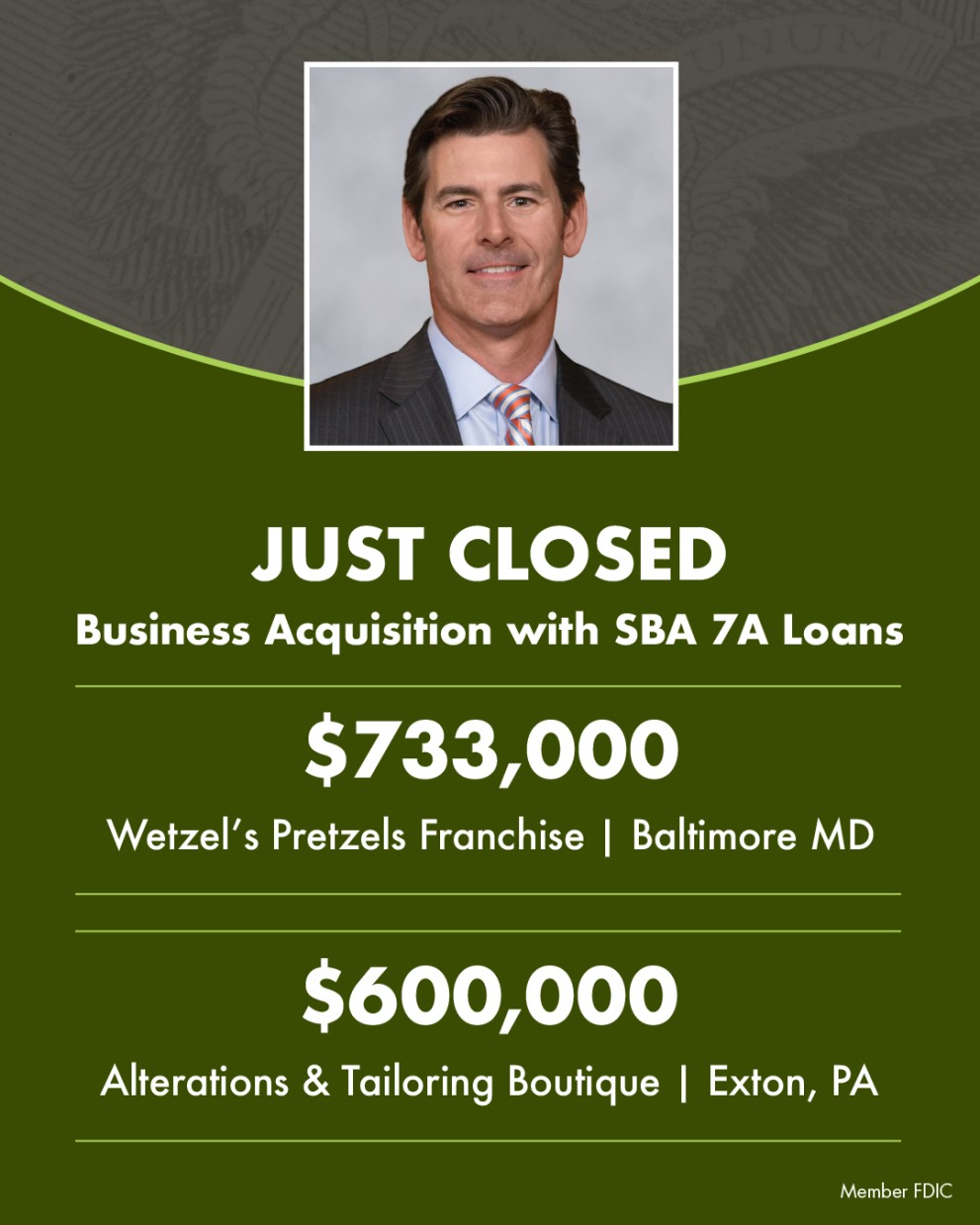

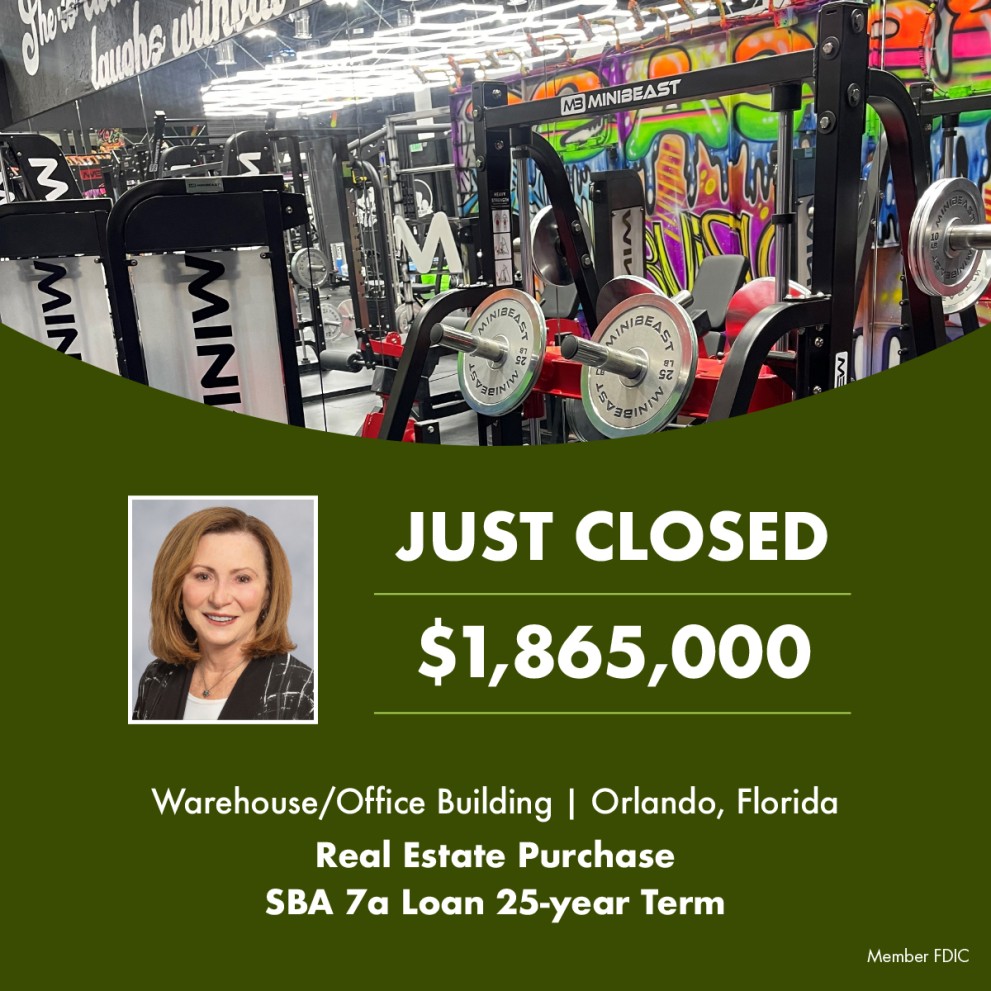

44 NEWS

The 44 Advantage…

- Access to the Decision Makers

- Speed to Decision

- No Loan Covenants

Our Clients…

- Refinance existing debt

- Purchase commercial real estate

- Expand or purchase a business

- Invest in new machinery & equipment

- Improve company cash flow

- Preserve Countless Jobs

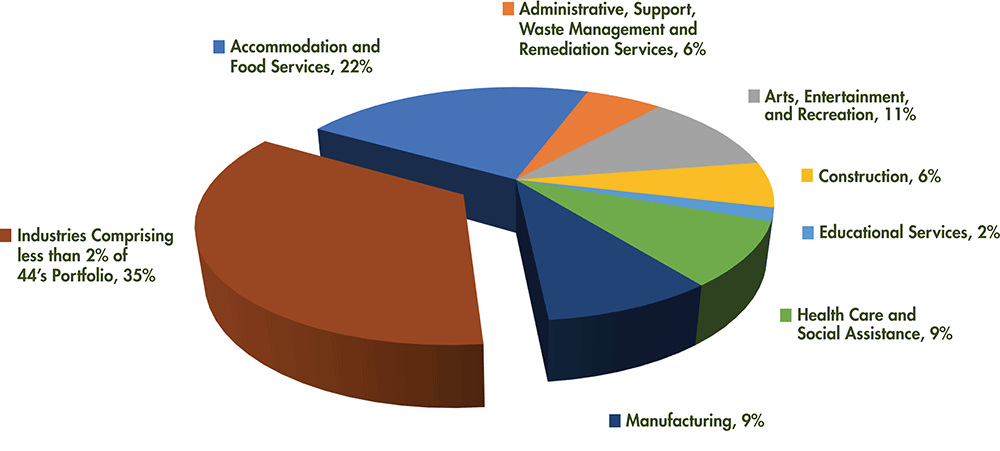

Diversity of Industries Served by 44 Business Capital

While some providers specialize in lending to a few industries, 44 serves a variety of industries from manufacturing to Montessori schools.